[Reuters, 2023] reported, “U.S. small business confidence fell to the lowest in over a year in February in the face of a wave of inflation that is forcing a record percentage of establishments to raise prices and denting their outlook for the economy, survey showed” last Tuesday.

The Small Business Optimism Index “dropped 1.4 points to 95.7 last month from 97.1 in January. It was the lowest reading since January 2021. More than a quarter of businesses cited inflation as their largest problem, the highest since 1981, while a record 68% said they were pushing through price increases of their own. But higher prices weren’t feeding through to bottom-line profit improvements in many cases, with a larger share of businesses reporting weaker earnings and more than 60% complaining of lost sales opportunities.” NFIB Chief Economist Bill Dunkelberg was quoted saying, “Inflation continues to be a problem on Main Street, leading more owners to raise selling prices again in February. … Supply chain disruptions and labor shortages also remain problems, leading to lower earnings and sales for many.”

[Bloomberg, 2023] reported “Twenty-six percent said inflation was the top issue encountered in operating their business in February, the most in monthly data back to 1986, said Tuesday. The group’s optimism index fell to 95.7, the lowest since January 2021 and below the median estimate in a Bloomberg survey of economists.”

[U.S. News & World Report,2023] highlighted data from the survey: “More than two-thirds of small businesses reported higher average selling prices while more than a quarter say inflation is their No. 1 problem.”

[MarketWatch, 2023] noted that “Six of the 10 indexes that form the headline figure decreased in February, one increased, and three were unchanged compared with the previous month…Supply chain disruptions and labor shortages also remain problems, leading to lower earnings and sales for many, Mr. Dunkelberg added.”

[Advisor Perspectives, 2023] reported that “Sixty-eight percent of small business owners reported raising selling prices to keep up with inflation. The index is at the 26th percentile in this series.”

In a contributor column in Forbes, NFIB Chief Economist Bill Dunkelberg highlighted the impact of inflation on small businesses: “Inflation is a tax, pure and simple…Main Street firms are raising selling prices.”

NFIB State Directors also commented on NFIB’s February SBET. Alabama State Director Rosemary Elebash was quoted saying in [Alabama Political Reporter,2022], “There’s no arguing that Alabama’s economy is stronger than it was after the COVID-19 shutdown began two years ago this month, but inflation and supply chain disruptions and a lack of qualified job applicants are making it hard for small businesses to fully recover.”

Arizona State Director Chad Heinrich was quoted saying in [The Center Square,2022], “Even with starting pay greatly higher than the state’s minimum wage of $12.80 per hour, plus benefits and paid leave, many businesses are being squeezed by the labor shortage and a lack of a motivated workforce. This is on top of the additional challenges they are facing with increased regulatory burdens and some negative consumer perceptions due to the impact of high inflation prices for many goods.”

[Y’all Politics, 2022] quoted a statement from Mississippi State Director McVea’s statement : “Without a doubt, our economy is better than it was after the COVID-19 shutdown began two years ago this month, but rising costs combined with the ongoing labor and supply chain issues are slowing the pace of recovery.”

Kevin Kuhlman, Vice President of Federal Government Relations, in response to today’s Bureau of Labor Statistics report (3/10) showing the **U.S. inflation rate rose by 7.9% in February**, the **fastest pace of acceleration in 40 years:**

“_Today’s report shows there is **no sign of inflation slowing down** and small businesses continue to feel the effect of the fastest inflation acceleration in decades. Small business owners are navigating this challenging economic environment by making business adjustments to pass on the higher costs of inventory, supplies, and labor, while also managing the ongoing supply chain disruptions and staffing shortages. Small businesses encourage their elected officials to enact policies that will promote economic growth and help, not hinder, the small business recovery.”

NFIB’s recent [monthly survey, 2023] shows 26% of small business owners reported that inflation was their single most important problem in operating their business, a four-point increase since December and the highest reading since the third quarter of 1981.

Congress Unlikely To Provide Further Pandemic Aid To Small Businesses

[CNBC, 2022] Rosenbaum reported, “A majority of small business owners on Main Street say they support more financial relief from the federal government, but the resolution of the battle in Congress last week over the spending bill for the federal government shows that it may not be coming.” CNBC said, “That’s even though the need is clearly there. Two-thirds of small business owners support more financial relief from the federal government, according to the latest CNBC|SurveyMonkey Small Business Survey for Q1 2022, as inflation continues to hit Main Street hard.” CNBC added, “The specific measures for small business where hopes have been highest are the Restaurant Revitalization Fund and Employee Retention Credit. … [NFIB] says while small businesses were left out of the spending bill, NFIB will continue to push for restoration of the Employee Retention Credit in the Covid-19 supplemental bill that is expected to be considered soon.” NFIB Vice President of Federal Government Relations Kevin Kuhlman was quoted saying, “Small businesses do not expect these problems to subside any time soon as expectations for future business conditions continue to decline.”

Email Marketing Can Address Small Business Marketing “Pain Points”

[International Business Times, 2022](SGP) (3/7, Desk) discussed how email campaigns can address small business marketing “pain points,” these being insufficient “resources to create marketing strategies,” financial constraints, and inadequate time for marketing. Email “can provide a high return on investment, reach a large number of people, and help you retain customers. For these reasons, it is a top-rated marketing channel among small businesses,” and can also help small business owners “understanding more about your viewers and growing your business.”

[Why Small Businesses Should Consider An Omni-channel Marketing Strategy, 2022] In 2022

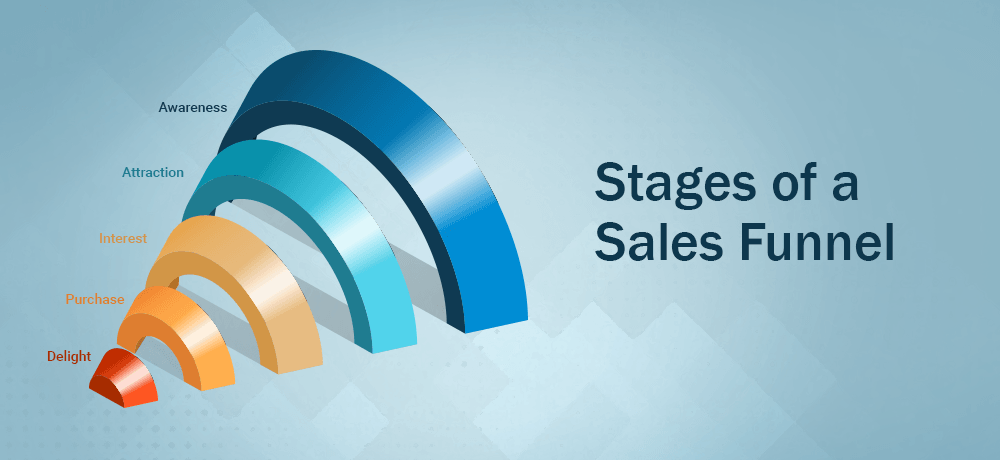

Techspective (3/11, Benson) recommended small businesses treat early 2022 as an opportunity to reconsider their current marketing strategy, highlighting the advantages of an omni-channel marketing approach. By focusing on traffic, conversion, and post-purchase engagement as three distinct elements of a marketing strategy, omni-channel marketing “helps ensure that you’re reaching the right people at the right time with the right tools. Dividing your efforts in this fashion will also help you solve” some of small businesses’ most common marketing problems. According to Techspective, “Not only will your marketing work more effectively by targeting critical consumer behavior, but it will also help you prioritize your marketing activities based on what works best while solving a few critical problems along the way.”

[Reuters, 2022] /Ipsos Poll: Americans Plan To Cut Restaurant Meals, Movies if Gas Prices Keep Rising

Reuters (3/10) reported that according to a Reuters/Ipsos poll completed Thursday, “U.S. consumers plan to cut spending on restaurant meals and movies if gasoline prices keep rising as Russia’s invasion of Ukraine rattles the global economy.” The poll found that “some 54% of U.S. adults expect to spend less on meals out if gasoline prices rise to between $6 and $7 per gallon. … Forty-nine percent said they would trim spending on movies and other entertainment. Some 60% said they would not drive as far for leisure activities.” According to AAA, “the average price at the pump on Thursday was about $4.32 per gallon, up from $3.48 a month ago. It said that gasoline prices could rise to a range of $6 to $7 per gallon if crude oil prices hit $200 per barrel.”

Food Inflation Reaches 41-Year Highs; Menu Prices Rise

[Restaurant Business Magazine, 2022](3/10, Maze) reported the February Consumer Price Index shows “overall food-away-from-home prices increased 4% in February.” Over the past year, food-away-from-home prices rose 6.8% while food consumed at home rose 8.6%, marking 41-year highs. In the same time frame, menu prices at limited-service restaurants rose 8%, and full-service restaurants rose 7.5%. Restaurant Business said that for now, “there is relatively little evidence to suggest the higher menu prices are keeping consumers away, though data is also skewed by the fact that consumers are simply not going to restaurants as often as they did.”

At Terzakis & Associates, we’ve long held: Information is empowerment!

Going forward, look here for opportunities for enrichment and action based information that empowers both you AND your small business.**